Contents:

- Explore Mutual Funds

- Keep your war chest ready to be able to buy at lower levels from where we are now: Manish Sonthalia

- Sensex, Nifty slip below 200-DMAs; investors lose Rs 6 lakh crore today

- What to do in this market crash? Just lie low and don’t act: Deven Choksey

- Russian stock market rout wipes out $250 billion in value

On 29th April 1992, Sensex dropped 570 points or 12.77%, and investors withdrew over INR 35 billion. The market fell after the 5000-crore scam perpetrated by Harshad Mehta came to light. He was the most popular broker of his time with a clientele comprising the who’s who of India.

- Companies like TCS, INFOSYS, WIPRO, HCL are extremely cash rich companies and very stable.

- If the fear and uncertainty is still around, the position can be closed and a similar position can be initiated in next month’s options.

- One downside to this method is that if the markets were to go up substantially higher from these levels ignoring all the pertaining risk, this strategy can quickly turn into losses.

- Assuming a 20L portfolio, one can buy 4 lots of strike Dec put options worth 40k.

On 24th Oct 2008, SENSEX fall by 1,070 points again in the economy. The worst fall in stock prices where experienced by Mahindra & Mahindra, Hindalco Industries, Tata motors, DLF and Reliance industries. This article is on the stock exchange which are few, particularly in the aptitude of stock markets crashes in India. Fear related to an unprecedented event has a domino effect in the stock markets that can send stock prices crashing, as investors look to pull their investments out before prices fall further. Since each investor is looking to sell, there is more supply of stocks than demand which leads to overall stock prices to collapse. The Stock market crash on September 3, 1929, to July 8, 1932, is considered one of the biggest stock market crashes.

Explore Mutual Funds

The key thing to remember is that fear leads to panic, especially among amateur investors. This panic often makes investor sell their investments at low prices during a stock market crash. No, a stock market crash only indicates a fall in prices where a majority of investors face losses but do not completely lose all the money. The money is lost only when the positions are sold during or after the crash. As we know, the stock market is volatile and if it falls today, there is no doubt that will also rise sooner than later. As a clever marketer, one should also build assets outside the stock market that can ensure continuous money flow even when the stock market crashes.

They did not get there without seeing a market crash and economic slowdown. Withdrawing now, especially from equity mutual funds, is not an optimal move. No one would invest in the asset class in the first place if it was a permanent thing.

Keep your war chest ready to be able to buy at lower levels from where we are now: Manish Sonthalia

All these events were totally unpredictable and we were never prepared for such instances, these things cause extreme panic and that’s when crash happens. Similarly 2008 Global Financial Crisis, none of the large institutions were prepared for it, they never though mortgage crisis could cause such a severe damage to the economy. The whole world collapsed when Lehman Brothers couldn’t find a buyer at the last minute to buy them out.

Every part of the economy was hit hard by the downturn, and the resulting political turmoil helped usher in William McKinley’s realigning election and presidency in 1896. EncilhamentoThis economic incentive strategy led to unchecked speculation, higher inflation, and a rise in the number of phoney IPOs and hostile takeovers. All of these incidents increased the strain on the banking system. The banking reserves of New York City declined from $50 million to $17 million during this phase. It was a gold panic on September 24, 1869, called “Black Friday,” and it was caused by the attempts of two speculators, Jay Gould and his colleague James Fisk, to corner the gold market on the New York Gold Exchange.

If you are not well versed with options pricing and behavior, this is not a recommended approach. Do sell a portion of your stocks when the market hits an all time high. If you do not sell, there is only notional profit and nothing else. If you dont sell a portion, your average cost will never come down and when a black swan event happen, your entire capital will be eroded. Sell a portion when the market hits high or stock hits 52 period high and buy back when there is a correction. But if we dig deep, we can see the market has gone through lot of intermittent corrections.

The early-stage funding and late-stage funding fell by 17 percent and 19 percent, respectively. Meanwhile, the seed-stage funding witnessed a small spike month-over-month. Peloton is downsizing by about 20 percent as part of a cost-cutting measure.

If we look at our country,India has been going through an economic slowdown for the past couple of years, even before the pandemic struck. A stock market crash offers investors a unique opportunity to grow their wealth. But to take advantage of this crash, you must have a plan in place before the crash happens.

The NASDAQ lost 80% of its value and S&P 500 lost around 50%, which greatly impacted the economy. The Fed has been raising interest rates aggressively over the months to fight the high inflation rate. Earlier this month, the Fed approved a rare half-percentage-point interest rate increase and a plan to shrink its USD 9 trillion asset portfolio. Notably, this is the largest increase in interest rates since 2000.

2 Cathie Wood Stocks That Have Tripled Since the 2020 Market Crash – The Motley Fool

2 Cathie Wood Stocks That Have Tripled Since the 2020 Market Crash.

Posted: Thu, 09 Mar 2023 08:00:00 GMT [source]

Twenty-three major stock markets in the world experienced a downfall in their stock values leading to an immense loss for investors globally. A crash is usually defined as a rapid double-digit fall in indices. A share market crash can start an economic recession, which can cause people to lose their jobs, businesses to decline in revenue, and consumers to spend less. This can cause stock prices to drop even more, making a cycle hard to break. While there is no universally accepted definition of a “market crash,” the word generally refers to a dramatic decline in an indicator of share prices over a day or several days. Share market crashes can devastate the economy and consumer sentiment.

Sensex, Nifty slip below 200-DMAs; investors lose Rs 6 lakh crore today

After all, during the pandemic panicked and purchased medicines as soon as they sniffled a little. This may have contributed towards the healthcare sector staying afloat. Similarly, as all the offices started working from home, the demand for laptops and computers increased, and the software sector thrived on the need for applications that would support the work-from-home setup. After the low, the market started recovering and grew by 32% to on 5th June. Looking at the past data, in 2008, Sensex saw a fall of around 61% from about in January 2008 to be around 8200 in March 2009, which is a period of 14 months. Even during the Great Depression, the Dow Jones saw a fall of 89% over a period of three years, after which it saw a steady recovery.

For the regular investor, equity mutual funds offer the best option because you cannot predict which firms will do well. Holding a portfolio that has been objectively selected by credentialed and time tested professionals is the more logical choice. Mutual fund investors should note that the MF units they hold are representative of the best of the economy.

What to do in this market crash? Just lie low and don’t act: Deven Choksey

Stock market crashes can heavily impact the value of the assets owned by the people. Market crashes are uncertain situations driven by factors like news rumors, natural calamities, economic failures etc. The factors are not directly related to the share market but they somehow affect the mindset of investors creating a decline in demand for stocks. Some are the harbingers of bad days ahead as the country’s business system collapses.

- Every time a connection likes, comments, or shares content, it ends up on the user’s feed which at times is spam.

- Car sales in India rose last month, sustaining the momentum of growth in the first three months of the calendar year on the back of new models and reduced waiting periods.

- Update your e-mail and phone number with your stock broker/depository participant and receive OTP directly from depository on your e-mail and/or mobile number to create pledge.

- Negative news such as a pandemic, an asset bubble that’s about to burst, scams being revealed, etc., can influence any investor.

With so many cyclical and circular events, you could say that the https://1investing.in/ market has its own “circle of life” . The growth numbers for India that we put out in October was 6.8% for FY2022 and 6.1% for the next year. The data that we have seen since then are in line with those projections. In terms of its performance relative to other countries, India is certainly in a relative bright spot because for about a third of the countries, GDP is basically contracting either this year or next. May will be interesting, and we could see the market consolidate. However, it’s safer to assume that April will continue to be a tough month for the equity market.

About 60% of low income countries are either already in debt stress or in high risk of debt stress. The G20 produces the common framework to help countries resolve this debt problem and progress has been made with a couple of countries. But a lot more needs to be done and India is on the forefront of pushing for concrete actions to get much faster debt resolution for countries.

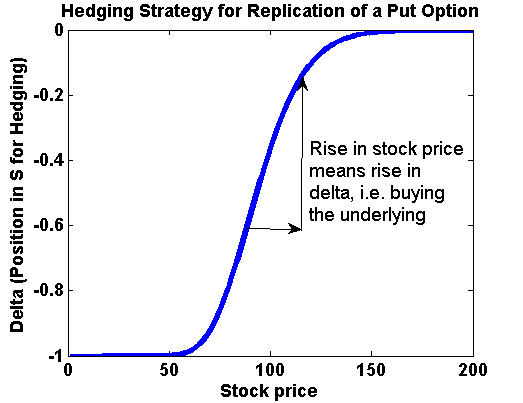

Readers can accordingly adjust the position size if they have high beta counters in their portfolio. Long Put Option is a plain vanilla approach that is often used by market participants to hedge their portfolio. As many as 110 of the stocks are linked directly to agri commodities, such as sugar, rubber, tea and coffee, the sector classification suggests.

Stock Market Crash Isn’t Over, According To Indicator With ‘Perfect’ Track Record – Forbes

Stock Market Crash Isn’t Over, According To Indicator With ‘Perfect’ Track Record.

Posted: Wed, 17 Aug 2022 07:00:00 GMT [source]

We have looked at the global outlook and the main challenges that the world faces. Again in the issue of food and energy security, there have been important steps that are being taken that have come out to work at the G20. All of that is important to deal with the cost of living crisis that we are seeing. “In the near term, with the news flow on Covid second wave intensifying, there will be buying interest in the Corona-proof’ sectors like healthcare, IT and chemicals.

At the end of the settlement period, Friends of Ambani asked for the delivery of the shares sold by the bear cartel. The cartel didn’t have the shares and Ambani didn’t allow the stock markets to open unless the trades were settled. This resulted in the stock markets remaining closed for three consecutive days. Investors should focus on investing in companies that have strong fundamentals. Companies that have the right risk-mitigating strategies in place tend to invariably come out of disruptive market events.

return on equity roe definitiones create a short duration of shortage of funds, to avoid financial issues, investors should make emergency funds for about 2-3 months. Many tech companies that raised funds over the years are still pre-revenue. Further, sales and profit are expected to slow down after nearly five years of explosive growth. “An entire generation of entrepreneurs & tech investors built their entire perspectives on valuation during the second half of a 13-year amazing bull market run,” said Bill Gurley, general partner at Benchmark.

A long-term investor has less to worry about the stock market situation as it doesn’t impact them with major hits. The reason for this is simple, the stock market’s volatility; if the market is on its knees today, in the coming few days, it will be up in the sky again. It is best to do nothing as a long-term investor as the wave continues to flow with both upward and downward thresholds. Coronavirus crash of 2020Various stock exchanges fell by 20 to 30 per cent.

One way to benefit from the lower cost of Equities is to change the allocation in long-term investments such asNational Pension System and Unit Linked Insurance Plans . Both NPS and ULIPs are long-term investments with multi-year lock-in periods. A cash flow statement is a record of all the money that is coming in and going out on a daily basis. By maintaining a personal cash flow statement, you can organize your finances better so that a stock market crash does not impact your ability to take of essential expenses such as utility bills, rent, tuition fees, etc.